Boeing Leads the Pack with $15.8B in Negative Shareholders’ Equity: A Risk Alert for Investors

Before investing in a company’s stock and as long as you own it, it is essential that you evaluate the company’s financial health. One critical area to research is a company’s shareholders’ equity. For example, when a company’s liabilities exceed its assets, it’s known as negative shareholders’ equity, indicating significant warning signs of elevated risk. We use the term “Illusion of Equity” to refer to scenarios in which liabilities exceed assets by 90% or when shareholders’ equity is negative. Boeing, one of the world’s largest aerospace companies, currently leads the pack with a negative equity value of $15,848,000,000.

The figure below shows that Boeing’s negative shareholders’ equity problem has persisted for years and could potentially have severe consequences for investors who hold Boeing stock.

In addition to its negative equity problem, Boeing also fails the profit question “is the company making money from its business?” The graphs below show that Boeing’s financial statements have shown a pattern of negative net income and negative cash flow from operating activities for years.

Our analysis finds that, as of March 31, 2023, there are over a hundred companies traded on the major U.S. exchange with fundamental risks similar to that of Boeing.

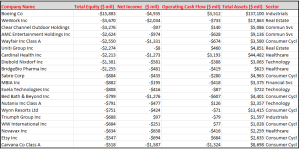

The following list features the top 20 companies, as of March 31, 2023, that are facing the Illusion of Equity problem along with negative net income and/or negative operating cash flow:

Companies with the Illusion of Equity problem, coupled with negative net income and/or negative operating cash flows, pose substantial downside risk to your portfolio if you are one of 140 million investors in the U.S. who invest in stocks directly or indirectly through mutual funds and ETFs. Predictive analytics from Valspresso shows that such companies are likely to deliver lower stock returns and higher risk across time and market conditions. Furthermore, if a company with the Illusion of Equity problem were to go bankrupt, common shareholders would likely lose their entire investment.

In conclusion, the Illusion of Equity problem along with negative profit are early warning risk alerts for investors. It is crucial to evaluate a company’s financial health before investing in its stock and to regularly monitor it. You can significantly improve your investment outcome by excluding companies with these problems from your portfolio.

Comments

Related Stories

Return homeLiked this story?

StockStories are just the beginning. Our goal is to empower shareholders by giving them information. Subscribe to stay up to date to the current stories and be the first to know when expand our platform.

Leave a Reply